Fair Housing Law cognoscenti will be happy to learn of new journal article by Robert G. Schwemm, acknowledged to be a principal academic authority in these matters. In a Columbia Law Review sidebar, Schwemm takes on the recent U.S. Supreme Court ruling on disparate impact and sorts through the ramifications, “What’s new and what’s not.”

Even for non-cognoscenti this article can be useful, given that it’s a fairly breezy (for a law journal) way of catching up with fair housing developments.

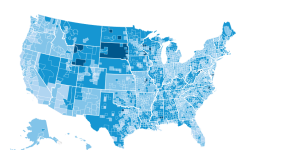

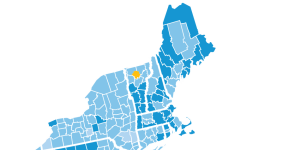

The court’s opinion – which essentially upheld the longstanding theory that discrimination is legally actionable by virtue of its effect, not merely intent, was celebrated by fair housing advocates all over the country. The impact on Vermont remains to be seen, however, because disparate-impact arguments typically rely on statistics, and Vermont communities are so small that statistics are not always meaningful.

Still, Schwemm ‘s article makes several points worth Vermonters’ notice, among them:

–the established practices, since the mid ‘70s, of using disparate impact to challenge “exclusionary zoning and other land-use restrictions by local governments that blocked or limited housing proposals of particular value to racial minorities or persons with disabilities.”

–the additional protected classes that Vermont (and many other states) added in their own fair housing laws are specifically preserved under the federal Fair Housing Act. Those additional categories in Vermont include receipt of public assistance (e.g. Section 8), sexual orientation and gender identity. The implication is that, because of the Supreme Court decision, disparate-impact claims could be made successfully for people in these, state-specific categories as well. Assuming, that is, that the plaintiff could get the necessary numbers in order.