Category Archives: housing crisis

Reform land use, promote shared growth of new housing

– San Francisco Chronicle http://www.sfchronicle.com/opinion/openforum/article/Reform-land-use-promote-shared-growth-of-new-9283703.php

By Jason Furman | September 25, 2016 | Updated: September 25, 2016 8:34pm

Photo: Michael Macor, The Chronicle

Photo: Michael Macor, The Chronicle

When certain government policies — like minimum lot sizes, off-street parking requirements, height limits, prohibitions on multifamily housing, or unnecessarily lengthy permitting processes — restrict the supply of housing, fewer units are available and the price rises.

It is no secret that cities like San Francisco, New York and Washington, D.C., face challenges in the availability and cost of housing. But policymakers and economists have increasingly recognized both the role that certain inappropriate land use restrictions play in raising housing costs — not just in major cities but across the country — and the opportunity for modernizing these regulations to promote shared growth.

Basic economic theory predicts that when the supply of a good is constrained, its price rises and the quantity available falls. In this respect, the market for housing is no different: When certain government policies — like minimum lot sizes, off-street parking requirements, height limits, prohibitions on multifamily housing, or unnecessarily lengthy permitting processes — restrict the supply of housing, fewer units are available and the price rises. On the other hand, more efficient policies can promote availability and affordability of housing, regional economic development, transportation options and socioeconomic diversity.

Research suggests that local barriers have become more restrictive in recent decades. One way to measure this is comparing the sale price of houses with construction costs. This gap typically reflects the cost of buying land — which increases with tighter land use restrictions. Indeed, the gap has increased in the past two decades: House prices from 2010 to 2013 were 56 percent higher than construction costs, a 23 percentage-point crease over the average gap during the 1990s.

Of course, many land use regulations can have benefits for communities. Environmental reasons in some localities may make it appropriate to limit high-density or multiuse development. Similarly, health and safety concerns — such as an area’s air traffic patterns, viability of its water supply, or its geologic stability — may merit height and lot size restrictions.

But in other cases, barriers to housing development can allow a small number of individuals to enjoy the benefits of living in a community while excluding many others, limiting diversity and economic mobility.

This upward pressure on house prices may also undermine the market forces that typically determine patterns of housing construction, leading to mismatches between household needs and available housing.

Improving land use policies can also create benefits for the U.S. economy as a whole. High- productivity cities offer higher-income jobs than low-productivity cities and often attract workers who move from other cities, naturally bringing more resources to productive areas of the country. But when unnecessary barriers restrict the supply of housing and costs increase, then workers — particularly lower-income workers who would benefit the most — are less able to move.

All told, this means slower economic growth: Some researchers have estimated that GDP could have been almost 10 percent higher in 2009 if workers and capital freely moved so that the distribution of wages across cities was the same as in 1964.

On the other hand, smarter land use and housing policy can promote both growth and equity. While most land use policies are appropriately made at the state and local level, the federal government can also play a role in encouraging smart land use regulations. Today, the Obama administration is releasing a new toolkit at http://bit.ly/2d4dVAc that highlights best practices that localities have employed — including streamlining permitting processes, eliminating off-street parking requirements, reducing minimum lot sizes, and enacting high-density and multifamily zoning policies — to reduce overly burdensome land use restrictions and promote mobility and economic growth.

Reforming land use policies can have important benefits for local residents and the nation as a whole, not only raising economic growth, but ensuring that its benefits are widely shared among all Americans.

Jason Furman is the chairman of the White House Council of Economic Advisers.

Why a housing scheme founded in racism is making a resurgence today

From: Wonkblog

By Emily Badger May 13 at 6:30 AM

Beryl Satter knew something like this was bound to happen. Or, rather, to happen again.

The Rutgers historian wrote the book on an obscure form of predatory lending from the mid-20th century that victimized black home buyers when banks would not lend them mortgages. Her book, “Family Properties,” came out in 2009, on the heels of the housing crash. And as she traveled the country talking about it — about families defrauded from the homes they thought they owned, about sellers who promised home ownership but collected deposits and evictions instead — people kept approaching her.

“Pretty much everywhere I go, people say ‘I’ve been hearing about this,'” Satter says. “Contract” lending is making a comeback.

In this model, buyers shut out from conventional lending are offered an alternative: They can make monthly payments on a home directly to the seller, instead of a bank, with the promise of receiving the deed only once the property is entirely paid off, 20 or 30 years down the road. In the meantime, they have few of the legal protections of a typical home buyer but all of the responsibilities of one. They don’t build equity with time. They can be easily evicted. And if that happens, they lose all of their investment.

According to the Detroit Free Press, more homes were bought in Detroit last year using such “land contracts” or “contracts for deeds” than conventional mortgages. In a series of recent stories, the New York Times has reported that Wall Street is now betting on this market, with investors buying foreclosed homes by the thousands and selling them on contract. Earlier this week, the Times reported that the Consumer Financial Protection Bureau is now investigating the practice’s resurgence, although it is not by definition illegal.

What is particularly alarming about the trend, though, is that we’ve seen it before. In its earlier incarnation, it was an explicitly racist form of exploitation. And now it is victimizing the same groups again: mostly lower income and minority home buyers who can’t access traditional credit.

“There’s nothing new here in the slightest,” Satter says. “This is just a continuation of the same old game. That’s what’s so disturbing.”

In the earlier era when this was common, between the 1930s and 1960s, contract lending was in some cities the primary means middle-class blacks had to buy homes. Real estate agents and speculators jacked up the price of properties two- or threefold. Then when families fell behind on a month’s payment or on repairs, they were swiftly evicted. The sellers kept their deposits and found the next family.

Satter’s father, Chicago lawyer Mark Satter, helped organize black Chicagoans to fight the practice in the 1950s. He estimated then that about 85 percent of homes bought by black in Chicago were bought on contract. “It was the way you bought,” Beryl Satter says. “There was no other way.” Many of those families then struggled to keep their homes in a system that was not sustainable by design.

Atlantic writer Ta-Nehisi Coates based his blockbuster 2014 article “The Case for Reparations”around the story of Chicago blacks who suffered under this system, the outgrowth, as he put it, of a segregated city with “two housing markets — one legitimate and backed by the government, the other lawless and patrolled by predators.”

The Times reports of what’s happening today sound eerily similar. Writers Matthew Goldstein and Alexandra Stevenson report that an estimated 3 million people have bought homes through contracts, although the numbers are hard to track given that the deals are regulated differently in each state and are not subject to the same disclosures as mortgages.

The practice is particularly common, they report, in distressed Midwestern communities like Akron and Detroit, where the government offered hundreds of foreclosed properties to investors in bulk sales. Those same investors, the Times reports, have turned around and sold the properties on contract to moderate-income buyers for sometimes four times as much.

Why now?

But why, though, would a financial scheme created in an era of sanctioned racial discrimination be making a resurgence today? Since Satter’s father tried to sue over the tactic a half-century ago, the Fair Housing Act and Home Mortgage Disclosure Act were passed. And the end of legal discrimination opened up legitimate lending to more blacks who were no longer forced into the housing market’s rapacious underworld.

But a crucial similarity between the two eras exists: Many people still can’t get loans today.

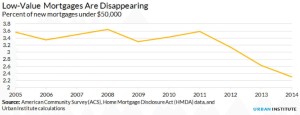

Now, this is the case because lenders have tightened their credit standards since the crash, overcorrecting for the bubble’s exuberance with historic stinginess. The Urban Institute has counted more than 5 million loans currently “missing” from the housing market — mortgages that would have been made between 2009 and 2014 if lenders used the kind of credit standards that were common back in 2001, a benchmark for more reasonable lending prior to the housing bubble.

Millions of Americans over this same time have had their credit ruined by foreclosures — in many cases because of predatory subprime lending that has now put them in the crosshairs of predatory land contracts. Minorities who were disproportionately targeted for the former are not surprisingly concentrated among those caught up in the latter.

“When the banks close down, people still need to buy,” Satter says. And so they find a way. Just as creative investors find a way to meet their demand. Land contracts are to housing whatpayday loans are to banking and Rent-A-Centers are to furniture. What people in need can’t access through credit someone is always willing to provide — for a price.

A lawyer for Harbour Portfolio Advisors in Dallas, one of the larger players in the new wave of contract lending, told the Times that the firm’s business model is “to purchase unproductive residential properties and sell them to other people who will make them productive again.” But Satter frames this differently.

“Choices that black Americans have had for housing loans have been predatory loans, or no loans,” she says. And when banks choose not to loan, she adds, this is who they choose not to loan to. “The result,” Satter says, “is a complete revival of redlining in a slightly different guise.”

This is why she wasn’t surprised to see the practice she’d studied as a historian (and lived through with her family in the 1950s) re-emerge as front-page news.

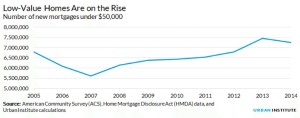

One other factor, though, helps explain why contract selling is back again. The demand among buyers who can’t get mortgages is deep. But so is the supply of houses that might accommodate buyers at the moderate end of the market. The foreclosure crisis created a vast stock of vacant homes, many of which have deteriorated through neglect. Steven Brown, an affiliated scholar at the Urban Institute, has shown that the number of homes worth less than $50,000 has been growing:

And this has happened as the number of small loans has dwindled:

So an investor who has bought up thousands of distressed foreclosures for $10,000-$20,000 a piece has to get creative. These properties need expensive repairs, meaning there likely isn’t much profit in repairing and renting them. They aren’t likely to appreciate much over time in stagnant markets like Detroit or Akron, so an investor can’t simply sit on them waiting for a recovery. And these homes can’t easily be sold at a profit to buyers — even with some modest flipping — because buyers in this market can’t get mortgages.

Contract lending, in other words, is just about the most profitable thing an investor could do with these homes. And that opportunity is colliding right now with a time of desperation for would-be buyers.

One way to look at this situation — today or in the 1950s — is that a market failure exists. Something is not working right in the world of legitimate home lending that’s causing families to reach for dubious alternatives, and that’s prompting dangerous models to proliferate. Satter, though, doesn’t see it this way.

“It’s a market success,” she says, viewed from the standpoint of the investors. “They figured out a great way to make a huge amount of money in this situation.”

As for market failures, she says, maybe we should rethink the term. “If you’re looking at how a market works, this is how it works – people saw an opportunity, they came in and grabbed it,” she says. “The market doesn’t care about fair housing for people, or that families need a place to live.”

And that is the other lesson of history that is repeating itself.

Emily Badger is a reporter for Wonkblog covering urban policy. She was previously a staff writer at The Atlantic Cities. Follow @emilymbadger

Connecting the dots: Housing cost- community economic development – JOBS! Part 1

The insufficient supply of housing at a range of affordable prices, especially for rental housing, has important negative impacts on local economic development. Housing costs and availability impacts adequate workforce availability. The causes of high housing costs are multiple but a few factors are controllable by local municipalities, counties and regions with the understanding and political will. Exclusionary housing development zoning regulations for example fall into that category. Housing supply constraints affect local employment opportunities and wage dynamics especially in areas where the degree of zoning regulation barriers are more severe.

It’s getting much tougher to find good jobs in areas with adequate affordable housing opportunities. Even when job markets improve, the absence of strong sustained real income growth means that for more and more communities, the relative cost of housing will continue to climb at the same time the availability of adequately affordable housing is decreasing.

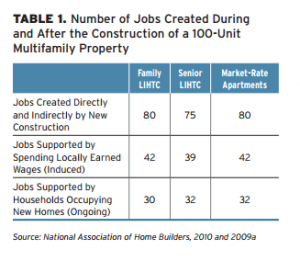

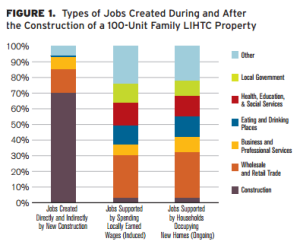

Research shows (see, “The Role of Affordable Housing in Creating Jobs and Stimulating Local Economic Development: A Review of the Literature” Center for Housing Policy) that adequate affordable housing in communities has benefits extending beyond its occupants to the community at large. Without a sufficient supply of affordable housing, employers and entire regional economies can be at a competitive disadvantage because of their increased difficulty attracting and retaining workers.

The excellent study referenced above provides a clear discussion of this issue. The primary thesis of the study is that developing more affordable housing in communities creates jobs — both during construction and through new consumer spending after the homes have been occupied. The positive impacts of building affordable rental housing are on par with and in many respects exceed the impacts of developing comparable market-rate units.

The take away from this is that housing affordability, inclusive communities and vibrant economic development, are intertwined in substantial ways. Communities can positively change the dynamics with various policies including favoring appropriate density in zoning laws.

Housing as a Vaccine

The 2016 Homelessness Awareness Day and Vigil was held at the Vermont State House in Montpelier on January 7th. Two House committees Housing, General and Military Affairs and Human Services had a joint hearing on homelessness, taking testimony on housing and homelessness issues. A number of other hearings regarding homelessness happened in the building during the course of the day.

Opening the hearing was nationally recognized pediatrician Dr. Megan Sandel (principal investigator on Children’s Health Watch, Associate professor at Boston University’s School of Medicine, and Medical director, at the National Center for Medical-Legal Partnership at Boston Medical Center), who has done path-breaking work on the effects of housing insecurity and homelessness on children. She gave a brilliant presentation on “Housing as a Vaccine: A Prescription for Child Health.”

At that hearing, Representatives and attending members of the public also heard from Vermont homeless service providers Linda Ryan (Director of Samaritan House) and Sara Kobylenski (Executive Director of Upper Valley Haven) on the latest trends and some recommended solutions to end or decrease homelessness in Vermont.

At Noon, community members, legislative leaders, administration officials, and advocates took the State House steps for a vigil to remember our friends and neighbors who died without homes, and to bring awareness of the struggles of those still searching for safe and secure housing. U.S. Senator Patrick Leahy and other legislative representatives and advocates joined and spoke at the vigil.

How can Housing be a Vaccine?

Dr. Megan presented data to support her thesis that housing can be protective for health. The quality, stability and affordability are important determinants to heath of all people. That means improving housing can provide multiple benefits. According to Dr. Megan, timing and duration of housing insecurity matter greatly to a child’s health. By increasing availability, affordability, and quality of housing, the health effect of housing insecurity can be decreased. Dr. Megan also provided specific evidence regarding housing quality and children’s health. For example, developmental issues, worsening asthma and other conditions have been tied to specific housing conditions such as pests, mold, tobacco smoke, lead exposure and so forth, and tied to long term effect with poor health outcomes.

According to Children’s Health Watch, “unstable housing, hunger and health are linked” because evidence shows that being behind on rent is strongly associated with negative health outcomes such as high risk of child food insecurity, children and mothers who are more likely in fair or poor health, children who are more likely at risk for development delay, mothers who are more likely experiencing depressive symptoms. Research conducted by the National Housing Conference from Children’s Healthwatch illustrates that there is no safe level of homelessness. The timing (pre-natal, post-natal) and duration of homelessness (more or less than six month) compound the risk of harmful childhood health outcomes. The younger and longer a child experiences homelessness, the greater the cumulative toll of negative health outcomes, which can have lifelong effects on the child, the family, and the community.

Several community representatives spoke in support of increasing housing affordability by targeting more public funding to support housing affordability and housing stability and adding to state housing directed funds with a $2 per night fee on hotel, motel and inn stays.

And another thing

This is the last grant-funded post, so we’ll try to keep it snappy, not sappy. What do we know about housing, anyway? Not a lot, but a good deal more than when we signed on to this gig 10 months ago.

For what they’re worth, we’ll leave you with a gratuitous thought and an anti-climactic ranking.

Housing can’t simply be left to the private market, any more than health care or education. It’s time for people to accept that resolving the housing-affordability crisis will require significant new governmental investment; and alleviating the socioeconomic and racial segregation that continue to stand in the way of fair housing choice, all across the country, will require concerted government intervention. Why shouldn’t the right to decent housing and fair housing choice be a public policy priority commensurate with the right to health care or the right to receive an education?

Rankings abound at New Year, so here’s one with an ancillary question: Rent or buy? 504 counties around the country are listed in order of rental affordability — that is, the percentage of local median income that’s required to pay median rent of three-bedroom apartment in that county. Also listed is the affordability percentage of a median priced home. Compare the percentages to see whether it’s more affordable to rent or buy.

No. 1 in rental affordability (or unaffordability) is Honolulu, at 73 percent. Buy. No. 505 is Huntsville, Ala., at 23 percent. Buy.

You can get to the Excel table by clicking here.

The only Vermont county in the table is Chittenden (listed as Burlington/South Burlington). Sorry, Bellows Falls, Bennington, et al, but that’s the way of these national surveys.

Burlington/South Burlington comes in at No. 152 in rental affordability, at 40 percent. Buying affordability: 46 percent. The recommendation: Rent.

That’s despite the fact that, according to the table, the cost of a 3 BR apartment in Burlington/South Burlington went up 12.2 percent in the last year.

Sounds a little high to us (so much for the 3.3 percent figure we’ve been hearing) but again, what do we know?

Could be worse.

Something out of nothing

Here’s an intriguing strategy for revitalizing moribund downtowns that doesn’t cost anything and bypasses political machinations:  It’s called “Renew,” and it was first employed in the decaying Australian city of Newcastle several years ago — with notable success.

It’s called “Renew,” and it was first employed in the decaying Australian city of Newcastle several years ago — with notable success.

The basic idea is to install artists or craftspeople in vacant storefronts and let them work, market, or exhibit in exchange for their paying the utility bills.  In other words, let them dress the places up and draw people in… until the spaces are commercially leased, at which point the artisans have 30 days to vacate. A nonprofit organization facilitates these pop-ups.

In other words, let them dress the places up and draw people in… until the spaces are commercially leased, at which point the artisans have 30 days to vacate. A nonprofit organization facilitates these pop-ups.

Renew Newcastle spread to other cities, gave rise to Renew Australia, and was the subject of an article in The New Republic earlier this month, “Hacking the City: A New Model for Urban Renewal.” There’s no reason, the article suggests, why “Renew” couldn’t work in American cities, and not just big ones. Renew’s creator, Marcus Westbury, offers an aphorism – “Activity creates activity, and decay creates decay” — that would seem to apply anywhere. Even in small-town Vermont, where vacant storefronts are a common sight in many municipal centers — St. Johnsbury or Barre, Springfield or Rutland. Eastern Avenue in St. Johnsbury, for example, has a stretch of empty, eye-averting properties that could theoretically — with a Renew-style makeover — become a destination.

What does any of this have to do with housing? A downtown commercial/cultural revival might produce a hub of burgeoning activity where all sorts of people might want to live, thus drawing housing developers to a municipality they might otherwise be inclined to avoid.

https://www.youtube.com/watch?v=6n0ADYyy28w

A little holiday cheer

- Portland, Ore., has come up with a new funding source for affordable housing: tourists!

The city council has voted to dedicate a share of the tax on Airbnb-type rentals to the city’s Housing Investment Fund — $1.2 million a year. That’s a drop in the bucket in a city where the affordable housing shortfall amounts to about 24,000 units, but it’s better than nothing.

The city council has voted to dedicate a share of the tax on Airbnb-type rentals to the city’s Housing Investment Fund — $1.2 million a year. That’s a drop in the bucket in a city where the affordable housing shortfall amounts to about 24,000 units, but it’s better than nothing. - Jackson Hole officialdom has agreed to consider a plan that would dial back commercial growth in favor of housing, with density bonuses offered for workforce housing. A citizen campaign bearing slogans like “Housing not hotels” apparently got a receptive hearing.

- The Republican leadership of Howell, N.J., is backing an affordable housing project despite, and in the face of, some unusually ugly civic opposition — in a state where support for affordable housing is typically associated with Democrats.

This profile of courage, in the Atlantic, includes a fine summary of the tortuous (and torturous) fate of affordable housing in New Jersey after the landmark Mount Laurel decisions. Another example of how good intentions and a supportive legal infrastructure are not enough.

This profile of courage, in the Atlantic, includes a fine summary of the tortuous (and torturous) fate of affordable housing in New Jersey after the landmark Mount Laurel decisions. Another example of how good intentions and a supportive legal infrastructure are not enough. - The “recapitalization” of Freddie Mac and Fannie Mae, as proposed by two economists, would direct a flood of new money to the states for affordable housing via the Housing Trust Fund and the Capital Magnet Fund.

Vermont would get $4.6 million a year for affordable housing for 20 years under this scheme. Sounds great, but whether this proposal has any legs is an open question. Some members of Congress would just as soon do away with Freddie Mac and Fannie Mae altogether.

Vermont would get $4.6 million a year for affordable housing for 20 years under this scheme. Sounds great, but whether this proposal has any legs is an open question. Some members of Congress would just as soon do away with Freddie Mac and Fannie Mae altogether. - A community of 15 tiny houses is scheduled to open later this month in Seattle to provide transitional quarters for homeless people. Granted, this isn’t exactly cheerful news, but at least it’s different.

Nagging question

How does an affordable housing development affect surrounding property values?

There’s no simple answer to this question, in part because of the many variables that come into play– the siting, for example, and the nature of the neighborhood (blighted? well-to-do?), the scale of the development, the design, and so on.

Not surprisingly, though, the question has spawned a large literature. A rather dated survey of the research, from the Furman Center at NYU, found that “the vast majority of studies have found that affordable housing does not depress neighboring property values, and may even raise them in some cases.” A “Field Guide to Effects of Low-Income Housing on Property Values,” put out by the National Association of Realtors and citing numerous references, updated last year, agrees: “Most studies indicate that affordable housing has no long term negative impact on surrounding home values.”

Indeed, that’s the standard pitch that affordable-housing advocates make in the face of NIMBY opposition: The notion that affordable housing drives down property values is a “myth.”

Then, along comes a study with an inconvenient conclusion, seemingly muddying the water. That would be “Who Wants Affordable Housing in their Backyard? An Equilibrium Analysis of Low Income Property Development,” by Stanford economists Rebecca Diamond and Tim McQuade. Their finding is that, within a 0.1-mile radius, Low Income Housing Tax Credit-financed developments raise property values over the long run in low-income neighborhoods but lower them in higher-income neighborhoods. They conclude: “Given the goals of many affordable housing polices is to decrease income and racial segregation in housing markets, these goals might be better achieved by investing in affordable housing in low income and high minority areas, which will then spark in-migration of high income and a more racially diverse set of residents.”

This conclusion runs contrary to the spirit of affirmatively furthering fair housing, which advocates a balanced approach for affordable housing investment: revitalizing blighted areas, on one hand, and desegregating higher-income areas, on the other. This dual approach also has the imprimatur of the U.S. Supreme Court, which effectively endorsed it in its ruling this summer upholding the disparate impact doctrine. (For our previous post on this, click here.) The court’s ruling favored a Texas plaintiff who argued that affordable housing projects should NOT be disproportionately sited in low-income minority neighborhoods.

While we await critiques of the Stanford study from the affordable-housing commentariat, we take note of various examples where affordable housing has not depressed property values in higher-income communities: Places such as Mount Laurel, N.J., epicenter of New Jersey’s fair/affordable housing movement, where a Princeton study found that values in surrounding neighborhoods were unaffected (for the New York Times account, click here). Or Weston or Wellesley, two of Massachusetts’ wealthiest communities, where a Tufts study found that mixed-income developments had no effect on surrounding property values, as reported via Shelterforce.

One factor that might well have a bearing, and that would not show up in the Census-tract-type data used by the Stanford researchers, is design. Affordable housing doesn’t have to look cheap or barracks-y. In fact, if the design is done well, affordable units can be hard to distinguish from market-rate units.

Planning consultant Julie Campoli demonstrates this in her “Thriving Communities” webinar/seminar presentation. She shows each of the following two slides of four photos each and asks viewers to guess which is affordable and which market-rate. We’re giving the answer away by showing the labeled versions here, but her point should be obvious.

Renters’ agenda

The Center for American Progress has put out a report that nicely ties together, in summary fashion, the current status of fair housing and unaffordable housing. These are the mainstay, overlapping concerns of the “Thriving Communities” campaign. If you’re looking for a fairly brief (33 pages) treatment of where things stand, complete with an array of federal policy recommendations, “An Opportunity Agenda for Renters” is worth a look.

The report touches on many of the topics we’ve mentioned in this blog — the persistence of racial and socioeconomic segregation, the barriers to mobility from impoverished to high-opportunity areas, the growing financial burdens on the growing class of renters in the face of woefully insufficient public subsidies.

One of the policy recommendations, naturally, is that the primary federal vehicle for creating or preserving affordable housing be expanded. That’s the Low Income Housing Tax Credit, which accounts for about 110,000 residential units a year, according to the report. But even if that program were increased by 50 percent, as called for by the Bipartisan Policy Center’s Housing Commission, the total number of units created or preserved would still be way too few, considering “the current shortage of 4.5 million units that are affordable to extremely low-income households.”

As things stand, the federal tax code benefits homeowners in several ways, and disproportionately the wealthier ones. The mortgage-interest tax deduction alone costs the government about $70 billion a year. By contrast, increasing funding of the Section 8 program to cover 3 million eligible low-income renters who are shut out of the program now would cost just $22 billion.

Here’s another proposal in renters’ favor: creating a federal renters’ tax credit. A modest tax credit benefiting the lowest income renters could cost a mere $5 billion.

Vermont’s renter rebate is better than nothing, but it still doesn’t go very far. In 2012, according to a 2014 report to the Legislature, 13,541 claimants (about one-fifth of the state’s renting households) received a total of $8.7 million in rebates, for an average of $641. That $641 was not enough to unburden the typical claimant.

“On average,” the report stated, “Vermont’s renter rebate program reduces gross rent as a percent of household income from 36.7 percent to 33.6 percent.”

In other words, the average renter was living in an unaffordable place even after the rebate.